REVIEW IN CAPE TIMES ON 30 NOVEMBER BY JOURNALIST DIANE CASSERE

The Myth of ‘The Pin’ that Pricked the Bubble; That ‘Pin’ is here

The metaphor of a stockmarket bubble begets the search of that unique, definitive ‘pin’ that finally pops the asset bubble

However life isn’t that simple. Investors in search of the elusive pin, that singular financial catalyst that deflated the 2001 dotcom bubble or marked the onset of the Global Financial Crash (GFC) are still searching.

Reality is far more nuanced. It’s an accumulation of negative newsbytes, deteriorating prospects and increasingly euphoric valuations that painstakingly overwhelm the positives (or bullish thesis) to finally tilt the financial fulcrum downwards

Well the ‘pin’ has landed. I believe the weight of evidence points decisively to the end of the current bull market. I list my main arguments below.

Could I be wrong? Of course! However the real ‘unhinged’ Powell ain’t for another bout of QE. He’ll permit the ‘buy the dip’ mantra to be broken, in the interests of a more balanced future that restores greater potency to the Fed Toolkit.

Welcome back, real markets! As for now, prepare for the bear!

I can still remember my starry-eyed start to an investment career as an equities analyst in the ‘90’s. I witnessed the relentless ascent of the dotcom stocks more than two decades ago. Any company, however threadbare the strategy, product appeal or management depth, could add the suffix ‘.com’ to their organigram to secure a dramatic boost to their market valuation; a manifold over-subscription to an IPO was virtually guaranteed if the company had a few slides addressing the Y2K problem . It was fascinating!

What was equally intriguing was the bewilderment of many of my bosses, the ‘old-school’ fundamentalists who obstinately refused to accept the new paradigm of ‘market-cap-per-eyeball’. Eventually their faith in mundane metrics like profits and PE ratios was vindicated, but only after about 5 years of digital froth and insanity, where every ratio that depicted ‘the pin’ that would burst the bubble was over-ruled, and alas, a number of seasoned fundamentalists found themselves in a scrapheap, labelled as yesteryear’s old-school and redundant dinosaurs.

This is not a nostalgic trip down memory lane, but a reminder that the concept of valuation shifts with time and phase.

And there is no single catalyst or pin that bursts the bubble. I draw from one of my professors, (Charles Goodhart from the London School of Economics) who coined Goodhart’s Law:

When a measure becomes a target, it ceases to be a good measure.

Thus it should be in our complex symbiotic world, lest every investment professional be replaced by an ‘Artificially Intelligent’ computer which could map the measure with real-time, unerring precision and capitalise on the perfect selling point. It would seem fairly obvious that should such a measure and equation exist, we would all be trying to follow it, and thus it would be rendered obsolete by the change in human behaviour.

Yet the stockmarket imagery of a bubble and the elusive pin that bursts it prevails. Bearing the scars of attempts at reductionism of our complex markets (where countless forces and players stage their duels with varying fervour on a daily basis), I prefer to view it more like a multi-dimensional and delicate fulcrum that is ultimately reduced to one dimension: the bull and the bear argument. Each dimension (for illustration, consider technicals, monetary & fiscal stance, valuation, yield curve, GDP growth… each as one dimension) has a different (and varying) bearing or influence on the final fulcrum…but it’s that final bull/bear fulcrum that we’re interested in.

Before you get your hopes up, this article will not attempt to quantify the various dimensions and their weights (in my opinion that ‘model’ is beyond the scope of mere mortals), but it will propose that the bearish argument is finally heavy enough to hold sway; it is about to tilt markets downwards. I list the main arguments behind my conclusion.

Valuation, a significant, but far from definitive dimension

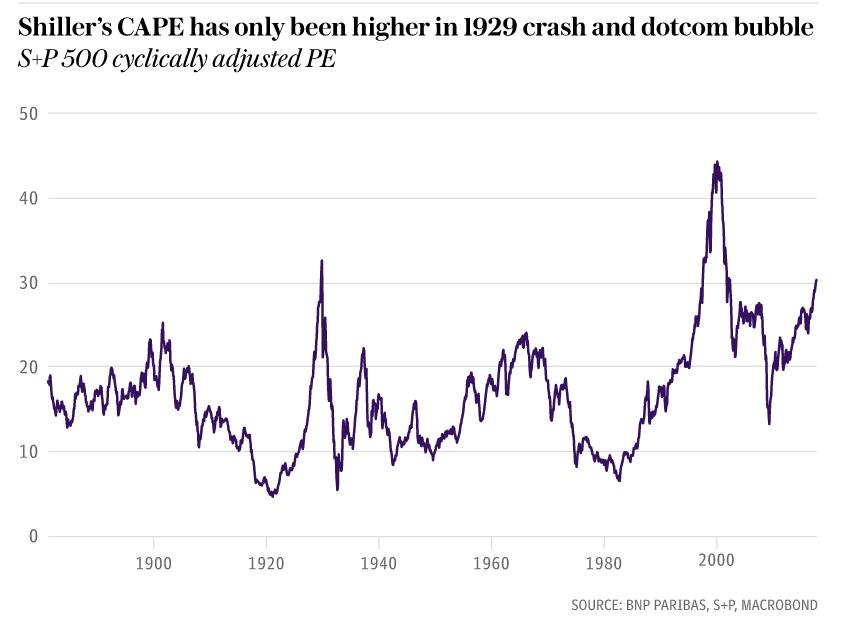

To the vocal delight of old-school fundamentalists, I trot out the valuation argument as a significant influence on my conclusion. The CAPE (cyclically adjusted PE ratio that takes the average of the last decade’s earnings) demonstrates just how precariously imbalanced the valuation fulcrum currently is:

We are massively tilted towards overvalued, if one considers the graph’s average PE (about 17) as the fulcrum. However, the die-hard fundamentalists should note it’s entirely possible to veer into overvalued territory for long durations! The fulcrum doesn’t automatically and periodically reset to equilibrium – ask the erudite Mr. Hussman who has my deepest respect (not kidding see his work!) for his diligent output on pre-announcing the oncoming bear for at least the last 3 years.

I believe the valuation argument has a significant bearing on the market’s future trajectory. Not definitive, not overwhelming, but significant. Now that we are so far stretched from equilibrium, nuanced shifts in other dimensions will combine to tilt the ultimate bull/bear fulcrum downwards, and thereby reduce the ‘ab-normalcy’ of current valuations.

Global Growth Momentum is Waning

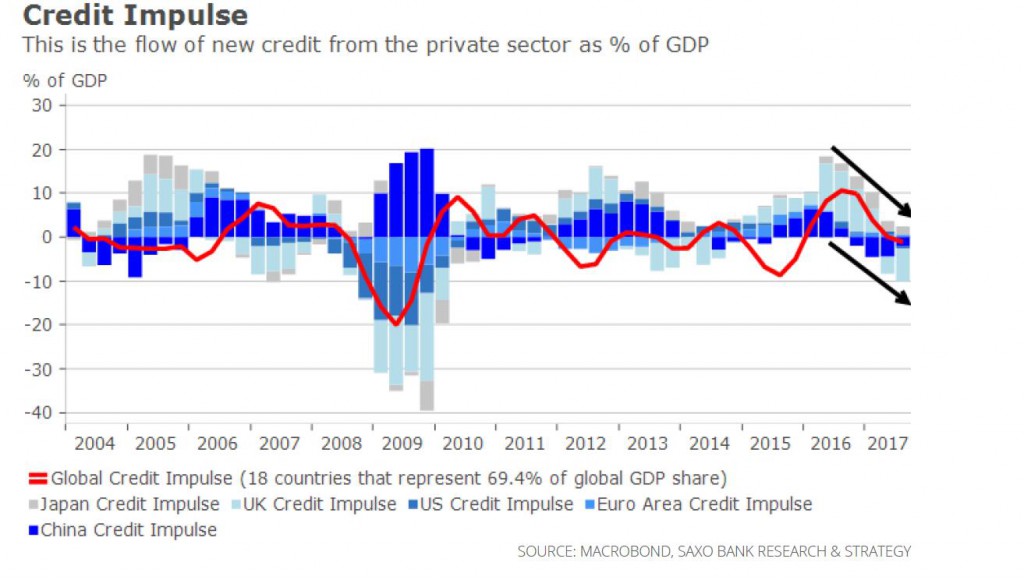

During ’17, one of the propellants of stockmarkets was the synchronised nature of global growth; global GDP was firing on all cylinders, and this was to provide a healthy tailwind to earnings for ’18. However, that narrative has changed swiftly, and the scope for further economic surprises (versus consensus estimates) is far dimmer than a mere quarter ago.

The private sector’s appetite for new credit is now synchronised to fall! The origin of this global unease could be the fear of protectionism or the fact that companies and consumers simply feel maxed out on debt! The concept of reaching a credit ceiling was expressed this month by the IMF

“… inflation may pick up faster than currently anticipated, possibly propelled by significant fiscal expansion enacted in the United States. Central banks may respond to higher inflation more aggressively than currently expected, which could lead to a sharp tightening of financial conditions. This tightening could spill over to risky asset prices…The fund warned there is an urgent need to reduce the burden of debt in both the private and public sectors to improve the resilience of the global economy and provide greater firefighting capability if things go wrong…”

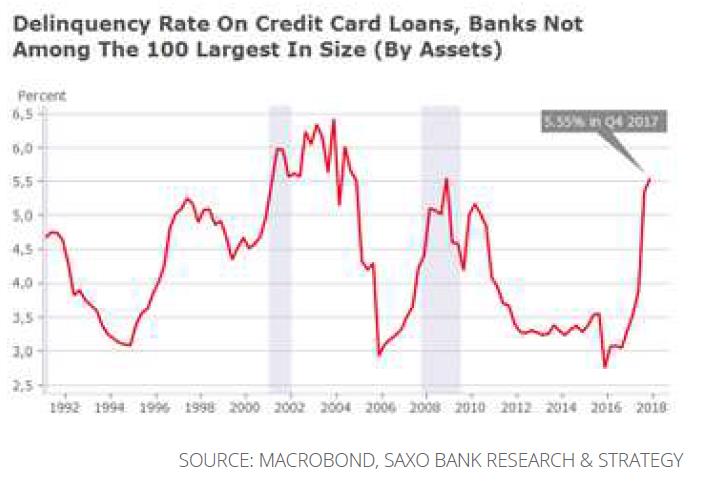

Irrespective of the source of refrain, credit growth could easily turn into a headwind for earnings, both from the perspective of higher delinquencies (see graph below on delinquencies on US credit cards which have eclipsed the ’07 Lehman Moment’), but also through lower consumer demand for loans and goods.

Technical Analysis: This significant fulcrum that now points down!

One of the wonders of stockmarkets is the extent of reflexivity, or how positive and negative behavioural loops can feed on themselves to generate a virtuous or vicious cycle. The application of reflexivity to stockmarkets is attributed to George Soros, a philanthropist/billionaire. His main criticism of the theory of perfect capital markets (prices will veer to a fundamental equilibrium predicated on valuation) is that the price itself (rising or falling) can be an important behavioural input: if markets rise, it begets more inflows and alters human (irrational) perceptions of fair value; the inflows precipitate a further rise, and this in turn attracts more inflows. The positive loop continues until an outcome breaks the positive loop, replacing it with a negative loop.

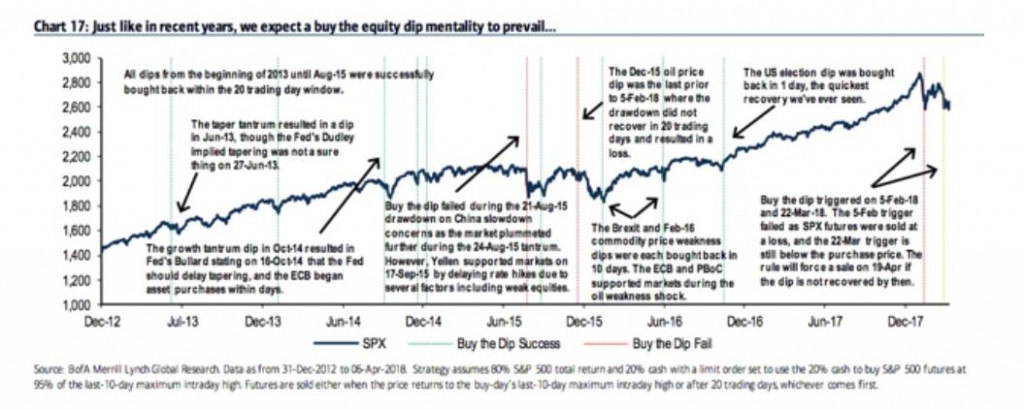

This is the best explanation of momentum trading that I have read, summarised by the adage, ‘The trend is your friend…until it isn’t.’ The ‘buy the dip’ mantra which was previously scorned by professionals as the last drawcard to attract the gullible retail investor has, in the last 5 years, transformed into a top-decile investment methodology that a mere handful of hedge fund managers have matched. This turn of events has been in no small way supported by the QE (Quantitative Easing) policies of the Central Banks. Note it was during Bernanke’s reign that the buoyancy of stockmarkets was first included as a factor that influenced monetary policy, in the hope that rising asset prices would encourage firms to expand capacity (more jobs) and augment consumer wealth/confidence (and subsequently demand) The QE experiment that Bernanke invoked provided a strong support base (the Bernanke and Yellen Put) for rising shareprices…a simple ‘buy the dip’ strategy (outlined in precise detail in the chart below) was in an article by a fellow SA contributor Heisenberg who drew on Bank of America Research), has proved to be virtually infallible since 2012! (Is it simple coincidence that this marks the onset of QE2 after QE1 changed investor behaviour? Or is it a perfect example of reflexivity at work…)

But here’s the bombshell. The axiom has been broken this year – not once but twice! To quote from this article, It’s Official: ‘Buy-The-Dip’ Has Failed. “Over there on the right-hand side, you can see that “buy-the-dip” (as defined above in chart text) has seemingly stopped working.”

This embodies my main argument why the sun has set on the bull market. The positive feedback loop has now been switched into negative mode. Each time the market dipped this year, the investor jumped in to capitalise on the dip; alas that cash flow registered a decline. This decline, in turn prompted other wary investors to pull out money…market drops further….and so the virtuous circle turns vicious.

Quantitative Easing turns to Tapering- the Fed Put has expired!

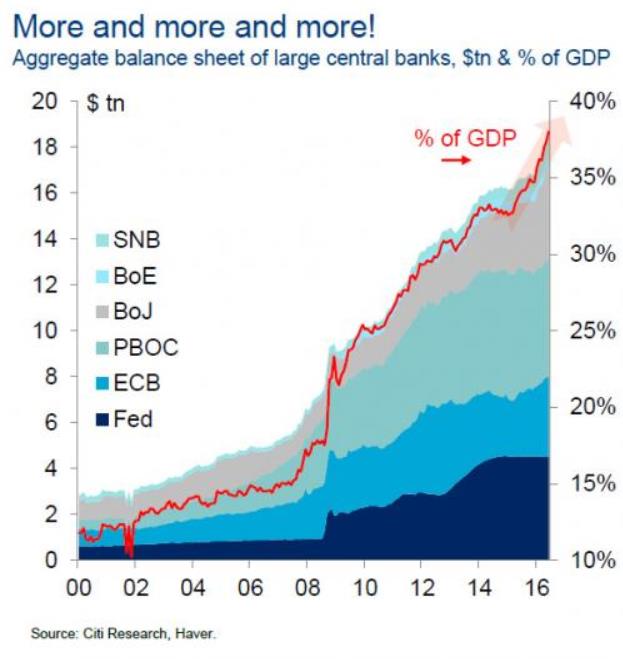

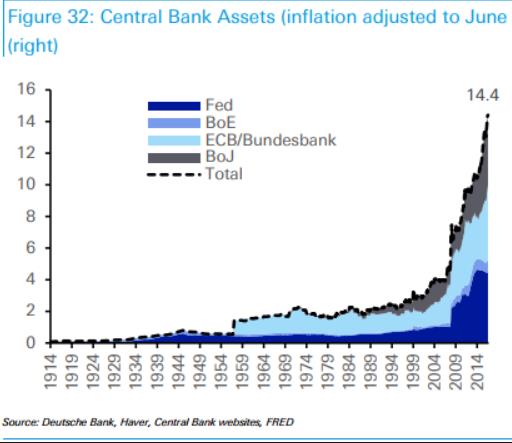

It is difficult to overstate the impact of this tectonic shift. The best way is visual: a long term graph of Central Bank (CB) balance sheets portraying the exponential expansion since the 2007 Global Financial Crash (GFC). I might be stating the obvious but it’s critical; the US under the helm of Fed Chairman Bernanke, embarked on an uncharted course (swiftly followed by the ECB, BOE and BOJ), that tackled the 2007 liquidity squeeze by central banks buying government bonds with money churned from the printing presses in their basements. One can get muddled in the detail, but there you have it. After decades of monetary prudence (i.e. a stable or marginally expanding CB balance sheet), the least painful path out of GFC was to inject liquidity into the global financial system. Central Banks ended up having a liability (the currency note they issued) versus an asset (the govt bond they purchased). The cumulative QE impact of the G4 central banks is depicted in the right chart below.

What should strike one like a baseball bat is that CB’s grew their balance sheets incrementally, in rough lockstep with their economies (GDP) for decades…until 2007…Then suddenly, we embarked on an entirely new experiment. It was called QE, whose consequences will no doubt be the subject of doctoral theses for the foreseeable future…

In summary, Quantitative Easing limited the depth and duration of the GFC recession. Alas the new drug was irresistible; CB’s have persisted in the quest of rekindling the real economy with a sea of liquidity for a decade after the ’07 crisis. Every occasion thereafter, when the economy (or more importantly for investors, financial markets) appeared fragile, they were resuscitated with another wave of liquidity, kind compliments of the CB printing presses.

Wall Street affectionately called the QE largesse the ‘Bernanke Put’; the baton was passed seamlessly to the successive Fed Chair, Janet Yellen. The sustained QE stimulus illustrated in the graph above shows Yellen showed little concern for moving into increasingly deeper and unchartered waters. And thus the adage ‘Buy the dip’ became a bullet-proof investment strategy that has excelled since 2012.

OK time to go deeper into the rabbit hole, the psyche of the Fed Chairperson. There is little doubt that both Bernanke and Yellen were unabashed QE-converts; distress calls from institutions like the IMF in 2017 were unheeded:

The fund warned there is an urgent need to reduce the burden of debt in both the private and public sectors to improve the resilience of the global economy and provide greater firefighting capability if things go wrong.

Moving on to 2018, both Bernanke and Yellen have left the stage. Enter Jerome Powell. He now has bears the institutional responsibility of sustaining the narrative; it appears to realise that it’s time to reverse the quantitative easing via a contraction of the liquidity injected since 2007. We are now in the era of Quantitative Tapering (QT) where the Fed will gradually sell its treasure chest of bonds (about $4.5 trillion) and erase the liquidity the sales generate. Powell’s undisputed primary imperative: to communicate effectively with market participants so as to ensure the contraction of liquidity happens in an orderly manner, without causing any disruptions in the economy or financial markets. The new Fed Chair’s official narrative is very much in line with ensuring a seamless transition from Yellen:

Steady as she goes. Powell, 64, who joined the Fed Board of Governors in 2012, has publicly backed the central bank’s plan of gradually raising interest rates. His term is likely to represent continuity with Yellen… Remaining on autopilot. Powell has endorsed the FOMC plan to gradually shrink the $4.5 trillion balance sheet, calling it “appropriate.” Market reactions to the plan “augur well for an orderly phaseout of reinvestments,” he said in June 2017.

Now hold on a moment. It doesn’t take a monetary genius to realise that the act – however gradual – of withdrawing trillions of dollars of liquidity from the financial system is going to have some monumental consequences. Surely one must concede if the QE experiment was uncharted, and resulted in the unintended consequence of edifying the ‘buy the dip’ mantra, then QT, the mirror reversal, may well embody unintended consequences. One example that has received much recent press is the spread between the three-month dollar London interbank offered rate (LIBOR) and the overnight index swap (OIS) rate. It usually hovers at around 0.1%, but has recently climbed to 0.6% (see chart below).

As it widens, bankers are bracing for a jump scare. As the Economist explains in the article, ‘Indicators that signal financial-market trouble are flashing trouble’

To see why, consider what each rate represents. LIBOR is the rate that banks charge other banks for unsecured loans. The OIS rate measures expectations for the federal funds rate, which is set by the central bank. As LIBOR rises above the OIS rate, that suggests banks fear it is getting riskier to lend to each other. (The gap was 3.65 percentage points in the depths of the crisis, after the Lehman Moment in 2007.)

I have no doubt that the shifting monetary tectonic plate is bound to lead to new fissures and exacerbate older cracks. This is why it’s crucial to penetrate the mind of Powell – if his opinion was ‘unhinged’, not collared by his institutional hat, how much weight would he attach to ensuring an orderly stockmarket…or would he be more concerned to withdraw the Fed’s unprecedented largesse and shrink its balance sheet as an urgent priority?

This leads to the crux of my hypothesis. In order to access Powell’s natural instinct, his unhinged narrative, one has to revert to the Federal Open Market Committee (FOMC) meetings. Only now do we have access to Powell’s honest opinion, the just-released minutes from their 2012 meeting. His comments came as the Fed was embarking on what effectively was the fourth leg of its asset purchase program, this one named QE3. And this is what he really thinks:

“I suspect that the channels that we’re using now, which principally are asset prices, may not be working at all as well as our models say,” he said at the July ‘12 meeting, two months ahead of the QE3 implementation. “On the list of potential costs, I would include inflation, the difficulty of exit, the risk of creating expectations we can’t meet, the prospect of capital losses, market function, and the grab bag of stability issues.”

In December 2012, Powell expressed additional worries.

“I’m concerned that the actions contemplated in this meeting are setting us on a path to a much larger balance sheet with likely benefits that are not commensurate to the risks that we’re bearing,”

At the risk of stating the obvious I draw your attention to two cardinal points:

-Powell is sceptical about the trickledown effect of asset prices on the real economy

-Powell is acutely aware that there are risks with expanding the CB balance sheet.

Whatever his official Fed narrative may be, this is the best intimation we have of his honest opinion. Jerome Powell is acutely concerned about the diminishing marginal utility of QEX. He is mindful that the tapering will have unintended consequences, but he is willing to shoulder the risks, in the interest of a Fed that is more poised to manage future problems.

Might I be wrong, that the bell tolls for the end of the bull market? Of course I might! Yet my hypothesis is vindicated by the absence of a ‘Powell Put’ this year. If you insist on the ‘pin that pricked the bubble’ imagery, consider Powell’s introduction as an important shift in weight, from the bull side (Yellen) to the bear side of the fulcrum. It’s not so much the sharpness of his pin as it is his weight that tilts that bull-bear fulcrum downwards. How’s that for a paradigm shift in imagery.

It’s high time for a two-way market. For now, get ready for the bear.